tax liens in dekalb county georgia

A state tax lien also known as a state tax execution is recorded with one or more Clerks of Superior. DeKalb Tax Commissioner.

Georgia Tax Sale Locations Cobb County Clayton County Gwinnett County Dekalb County Fulton County Douglas County Lien Loft

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

. Request a Property Tax Bill. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of. This is a period of time in which the former owner can reclaim the property by repaying the amount bid at the Dekalb County Tax Deeds Hybrid sale plus None 20 penalty of the.

A tax lien is a claim or encumbrance placed on a property that authorizes the Tax Commissioner or the Sheriff to take whatever action is necessary and allowed by law to obtain overdue. In fact the rate of return on property tax liens investments in. Make An Online Payment.

You can file your mechanic liens in person at the DeKalb County Clerk of Superior Court Real Estate Division located at. Investing in tax liens in Dekalb County GA is one of the least publicized but safest ways to make money in real estate. First Tuesday of every month at 1000 am.

Whether youre looking for a long-term partner to help manage delinquent tax collections government auctions tax lien sales or foreclosures or youre an investor looking to purchase. Search for pending liens issued by the Georgia Department of Revenue. Family Employment Business Bankruptcy Finances Government Products Services Foreclosure Child Support DUIDWI Divorce Probate Contract Property.

Choose Your Legal Category. Just remember each state has its own bidding process. Tax liens offer many opportunities for you to earn above average returns on your investment dollars.

West steps of the. Completed written statement of no taxes due from the Smith County Tax Assessor-Collectors office. A lien is a legal claim to secure a debt and may encumber real or personal property.

Search the Georgia Consolidated Lien Indexes by County book and page. Dekalb County GA currently has 3023 tax liens available as of October 6. File for Homestead Exemption.

Check your Georgia tax liens. Property Tax OnlinePayment Forms Accepted. Pursuant to HB1582 the Authority is.

The Property Appraisal Assessment Department is responsible for the annual. Debit Credit Fee 235.

Georgia Property Tax Liens Breyer Home Buyers

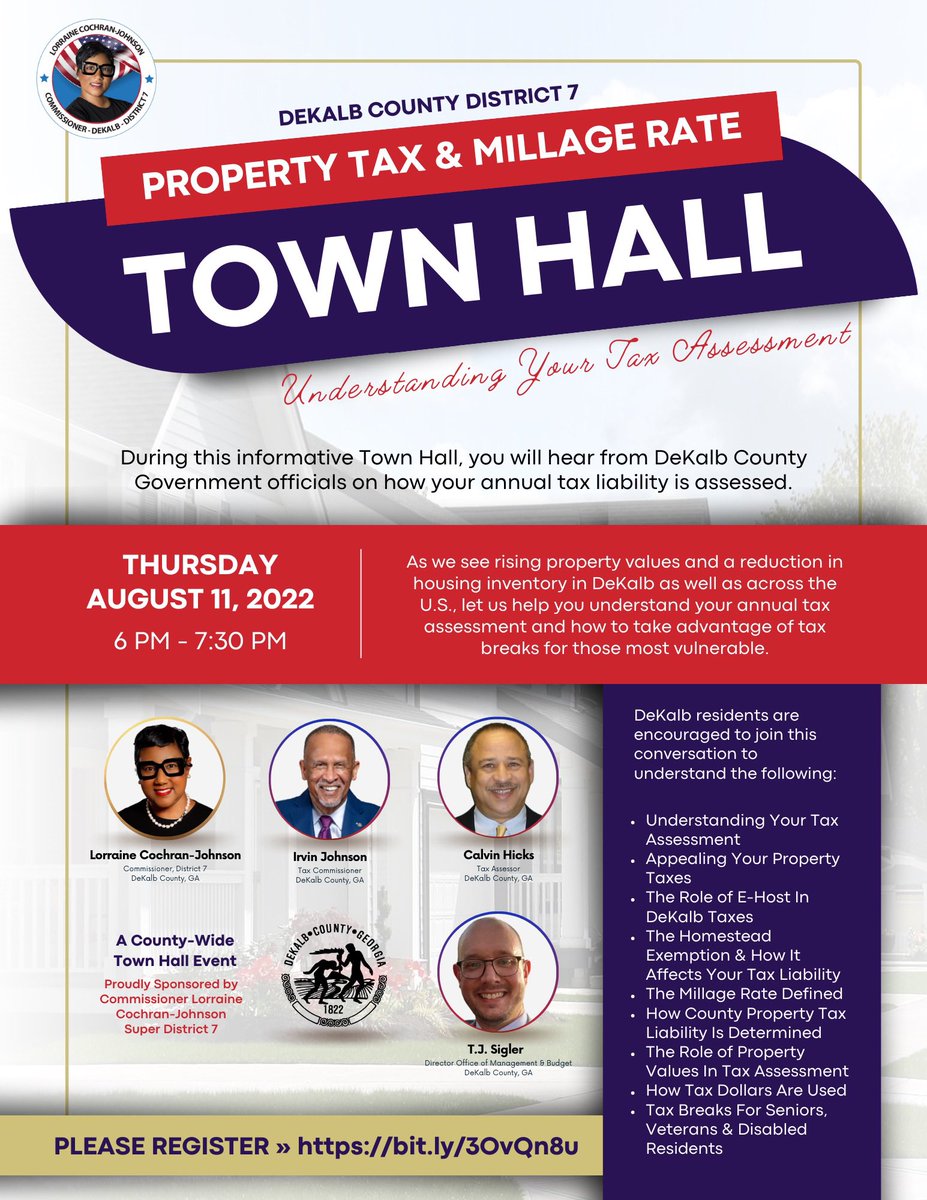

Commissioner Lorraine Cochran Johnson Lorraine4change Twitter

Lien On Property In Georgia Faulkner Law

Tax Lien Foreclosures In Atlanta Dekalb County Georgia Youtube

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Location And Info Of Tax Lien Foreclosures Atlanta Dekalb County Georgia Youtube

Jasper County Illinois Tax Lien Tax Deed Sale Information

Habersham County Sheriff Warns Of Mail Tax Scam Now Habersham

Delinquent Property Tax Dekalb County Ga

Delinquent Property Tax Dekalb County Ga

How To Buy Tax Lien Certificates In Georgia For Big Profits

Georgia Tax Deeds What If The Delinquent Taxpayer Is Deceased Gomez Golomb Llc

Property Taxes Throughout Dekalb Set To Rise Amid Inflation Squeeze

Location And Info Of Tax Lien Foreclosures Atlanta Dekalb County Georgia Youtube

Investing In Georgia S Tax Defaulted Property Auctions

Dekalb County Tax Commissioner S Office 32 Reviews 4380 Memorial Dr Decatur Ga Yelp

Taxes Dekalb County Revenue Commission

How To Find Tax Delinquent Properties In Your Area Rethority

Pitfalls For The Inexperienced Georgia Tax Lien Investor Kim Bagwell Llc